Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Hasu⚡️🤖

strategy @ flashbots and lido //

chef @ steakhouse

Optimistic proof systems will soon be the weakest link in speeding up settlement finality of bridges

vitalik.eth7.8. klo 00.29

Amazing to see so many major L2s now at stage 1.

The next goal we should shoot for is, in my view, fast (<1h) withdrawal times, enabled by validity (aka ZK) proof systems.

I consider this even more important than stage 2.

Fast withdrawal times are important because waiting a week to withdraw is simply far too long for people, and even for intent-based bridging (eg. ERC-7683), the cost of capital becomes too high if the liquidity provider has to wait a week. This creates large incentives to instead use solutions with unacceptable trust assumptions (eg. multisigs/MPC) that undermine the whole point of having L2s instead of fully independent L1s.

If we can reduce native withdrawal times to under 1h short term, and 12s medium term, then we can further cement the Ethereum L1 as the default place to issue assets, and the economic center of the Ethereum ecosystem.

To do this, we need to move away from optimistic proof systems, which inherently require waiting multiple days to withdraw.

Historically, ZK proof tech has been immature and expensive, which made optimistic proofs the smart and safe choice. But recently, this is changing rapidly. is an excellent place to track the progress of ZK-EVM proofs, which have been improving rapidly. Formal verification on ZK proofs is also advancing.

Earlier this year, I proposed a 2-of-3 ZK + OP + TEE proof system strategy that threads the needle between security, speed and maturity:

* 2 of 3 systems (ZK, OP) are trustless, so no single actor (incl TEE manufacturer or side channel attacker) can break the proof system by violating a trust assumption

* 2 of 3 systems (ZK, TEE) are instant, so you get fast withdrawals in the normal case

* 2 of 3 systems (TEE, OP) have been in production in various contexts for years

This is one approach; perhaps people will opt to instead do ZK + ZK + OP tiebreak, or ZK + ZK + security council tiebreak. I have no strong opinions here, I care about the underlying goal, which is to be fast (in the normal case) and secure.

With such proof systems, the only remaining bottleneck to fast settlement becomes the gas cost of submitting proofs onchain. This is why short term I say once per hour: if you try to submit a 500k+ gas ZK proof (or a 5m gas STARK) much more often, it adds a high additional cost.

In the longer term, we can solve this with aggregation: N proofs from N rollups (plus txs from privacy-protocol users) can be replaced by a single proof that proves the validity of the N proofs. This becomes economical to submit once per slot, enabling the endgame: near-instant native cross-L2 asset movement through the L1.

Let's work together to make this happen.

9,86K

Today, @SkyEcosystem and its decentralized stablecoin USDS got a B- rating from S&P (@SPGlobal ) - the first time they rated any stablecoin issuer, centralized or decentralized.

Some people are getting hung up on the B- because its not investment-grade yet when compared to established Tradfi issuances - that would be a big mistake.

Any crypto stablecoin/smart contract system is expected to get a more conservative rating, because Defi carries unique technological and regulatory risks. The rating is very fair and there is now a clear and surprisingly accurate framework to improving it over time.

This rating is a milestone for all Defi because it proves that decentralized protocols can meet the standards of major ratings agencies, paving the way for an adoption of crypto assets + issuers by existing Tradfi organizations.

Steakhouse Financial8.8. klo 04.27

Credit ratings compress complexity into clarity. In TradFi, they turn products into usable inputs. Unlocking liquidity, reducing search costs, and enabling scale.

For the first time, a stablecoin system has crossed that threshold. That stablecoin is @SkyEcosystem USDS

39,16K

Meh, disagree.

Compounding growth has never been more important than in today's world, and the more AI commoditizes resources like intelligence and labor, the more critical capital becomes

toly 🇺🇸1.8. klo 03.34

I actually have the opposite take. AI is already massively accelerating product cycles. Fail fast.

Launch the product, the fee switch and the token and give out 90%+ of it to users within the first year and let the DAO take over.

Whatever you are working on, there are 100 competitors all going full throttle. The one that wins it will make the right 3 or 4 decisions with limited information right out of the gate.

10,92K

Hasu⚡️🤖 kirjasi uudelleen

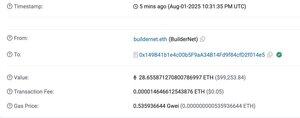

@Arnno39 @AlsieLC @filippoarman @web3sly @fr0zensun 2/ @ethereum’s second decade kicked off with a block built by @flashbots_x BuilderNet, a decentralized, MEV-sharing network already refunding users >1,000 ETH. A fitting milestone for a decentralized network that’s never gone down in 10 years.

4,18K

Hasu⚡️🤖 kirjasi uudelleen

Wow! Chainlink SVR just recaptured $100K (28.6 ETH) in liquidation MEV in a single transaction 🔥

And that's on-top of the ~$250K that SVR has already recaptured to date

More volatility -> more liquidations -> greater MEV recapture opportunity -> increased Chainlink revenue

109,44K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin