Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Everyone’s staring at ETH climbing to $4,700…

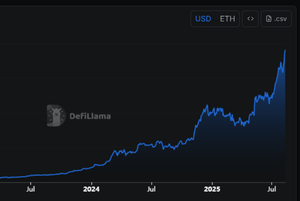

Meanwhile, Lido just smashed its ATH TVL, now at $41.53B.

DeFi giants like @AaveAave & @LidoFinance are back flexing.

Feels like a big DeFi summer brewing!

11.8. klo 21.45

can Aave’s deposits match Deutsche Bank before year’s end?

@aave's Founder @StaniKulechov is confident net deposits could hit $100B before year’s end

enough to put it in the top 35 banks worldwide, on par with giants like Deutsche Bank.

it’s already sitting at $61.1B, dominating 66% of the DeFi lending market.

The next biggest player? Morpho, with just $7.7B.

growth’s coming from both crypto natives and TradFi players:

> Nasdaq-listed BTCS is using Aave to earn yield on its ETH

> Ethena’s USDe stablecoin has poured $6.4B into Aave in just 10 days.

one catch: USDe’s massive share could pose risks if markets get shaky, according to Chaos Labs.

but for now, Aave’s momentum shows no signs of slowing.

Below is the Aavel TVL chart, hitting ath.

9,28K

Johtavat

Rankkaus

Suosikit