Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

What just happened?

Last night, news emerged of a "trade deal" that has never happened before.

Nvidia and AMD agreed with Trump to provide the US with 15% of REVENUE from chip sales in China to remove export controls.

Corporations are panicking. Here's why.

(a thread)

This deal marks a new era for American businesses.

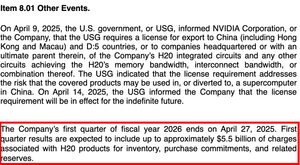

On Friday, the US Commerce department started issuing H20 export licenses again, but no one knew why.

It came just 2 days after Nvidia CEO Huang met with President Trump.

We now know exactly why things "quietly" changed.

Nvidia, $NVDA, took a $4.5B hit in the July quarter after Trump introduced the original license requirement.

Jensen Huang said the ban of Nvidia's chip sales to China would result in a $50 BILLION hit in 2-3 years.

This is when Jensen Huang knew he had to do something.

Instead, Nvidia is expected to sell ~1.5 million H20 chips to China in 2025.

This should generate close to ~$25 billion in revenue, per our estimates.

It would cost Nvidia ~$3.8 billion, much less than $50 billion over 3 years.

But, here's why it's truly a massive move.

The trade war has now entered an era where US businesses MUST make trade deals with Trump.

We saw the first signs of this in May 2025 when Trump threatened a 25% tariff on iPhones.

How did Apple respond?

A $600B investment in the US 3 days ago.

This was their "deal."

Intel is up next.

On August 7th, Intel stock, $INTC, fell after President Trump said their CEO “must resign immediately.”

He claimed their CEO was "highly conflicted" due to Chinese ties.

Intel's CEO is visiting the White House today to speak with Trump.

We expect a "deal."

The problem is, what happens to "small" companies?

Small businesses account for ~44% of US GDP, and the S&P 500 employs just 18% of Americans.

These businesses do not have the leverage to make individual deals with Trump.

Rather, they are hit by sweeping blanket tariffs.

The other question becomes, how will Trump decide who needs to make a deal?

And, will it open the door for previously restricted companies to sell to China?

Could Lockheed Martin sell F-35s to China for 15% commission?

This move opens up a massive can of worms.

Nvidia is arguably one of the most important and strategic assets that the US houses.

The company controls close to 90%+ of the global AI chip market.

If 15% commission allows them to sell to China and remove export controls, many other corporations are now thinking.

And, they are also panicking.

The trade war has now become about making individual deals with Trump.

If you can't make a deal, you are subject to the broader tariffs.

49% of Mag 7 revenue comes from outside of the US.

We expect Amazon, Meta, Tesla, and Microsoft to be next.

The market will soon react to these new deals as they are announced.

We believe it will actually push stocks higher, as the large names get larger and small names get smaller.

Want to see how we are trading it?

Subscribe to our premium analysis:

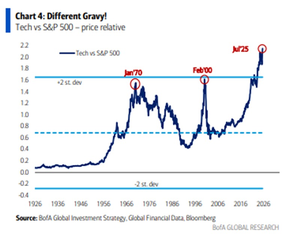

The outcome here will be an even more highly concentrated stock market.

The top 10 stocks now account for a record 40% of the S&P 500.

These will be the same companies making deals, widening the gap.

Follow us @KobeissiLetter for real time analysis as this develops.

5,16M

Johtavat

Rankkaus

Suosikit